Student Loan PSLF Form – The Student Loan PSLF Form is a 10-year digital document of your employment background. The right to appeal is available if the PSLF number is not satisfactory. The deadline is set for 2024. If you work for several agencies, you could be eligible for a reduced repayment waiver. Learn more about PSLF Benefits and how to fill out the form.

PSLF forms provide a 10-year digital record of your job history

The Student Loan PSLF Form provides a ten-year digital trail of your employment history . It is added to your student loan record. It is used to track the eligibility of a loan, record the amount of qualified loans, and also determine if the employer is eligible for an installment plan. The Department of Education recommends that you recertify your employment when you change employers or modify an income-driven repayment program.

It is recommended to complete the Employment Certification Form every calendar year if you want to be considered for the PSLF. The form verifies that you’re employed and meets the other requirements. This form is vitally important since it is the sole record that the government can use throughout the 10-year forgiveness period.

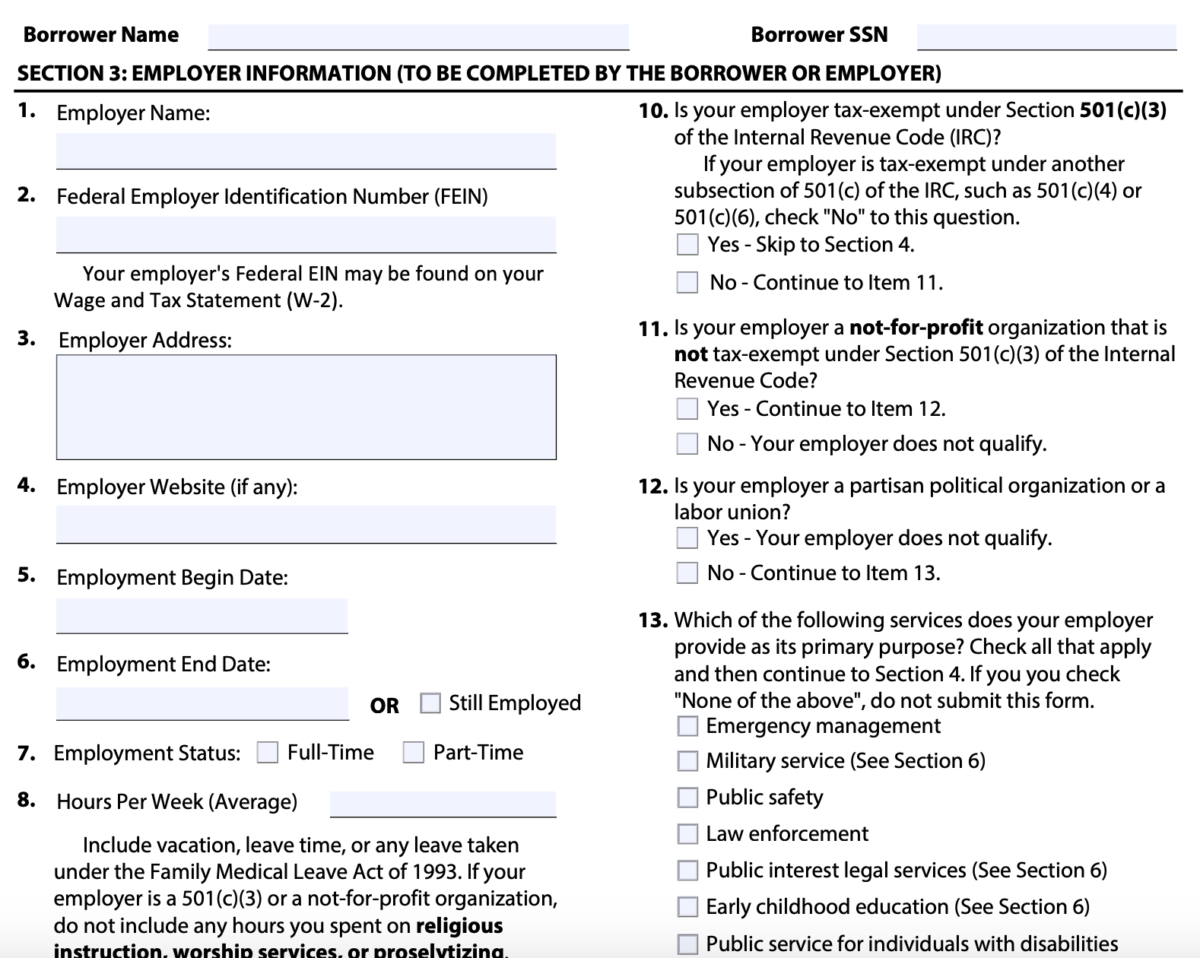

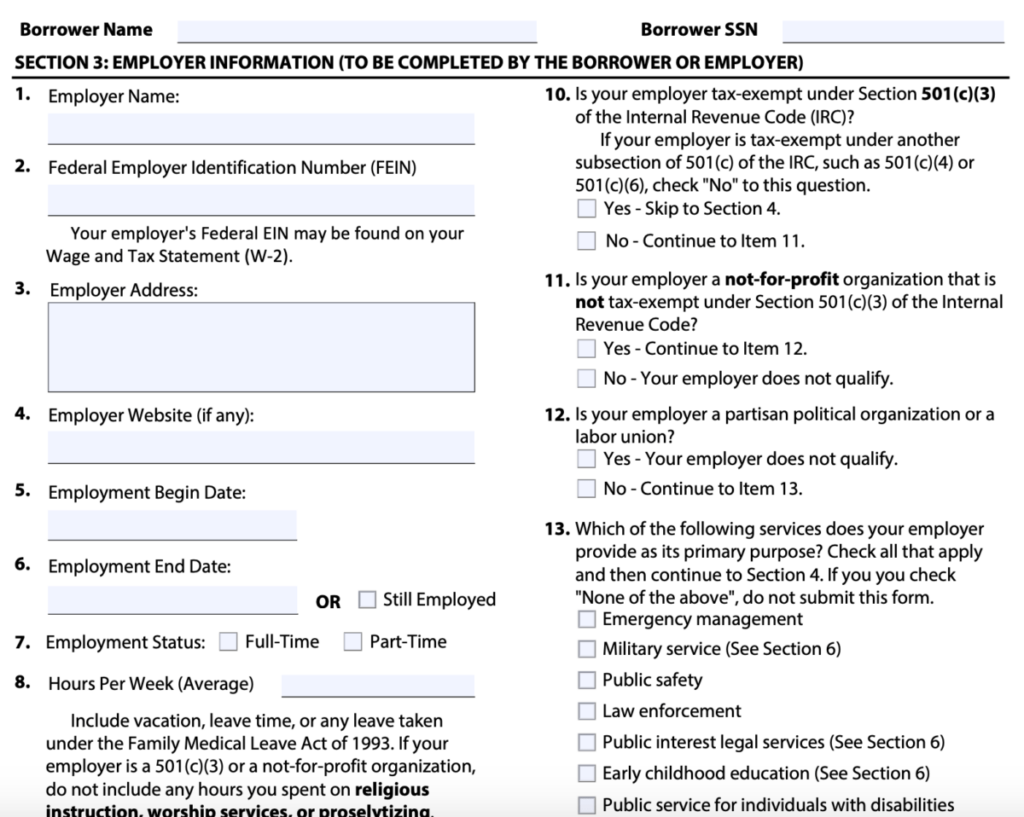

The PSLF forms must be completed by an Analyst from the Department of Human Resources. Employees should also complete them. It should be a wet signature (pen) and the employee must complete the form by the 31st of October 2022. For the U.S. Department of Education other administrative procedures may be required. Be sure to adhere to the rules.

The federal government funded and established the PSLF program. The Human Resources Department of Monterey offers assistance to PSLF applicants. The Human Resource Analyst will also verify your application dates. If you are not eligible to participate in the PSLF program, you may need to consolidate federal loan prior to the time limit expires. Before submitting your PSLF application, you should review the rules.

It lets you appeal the amount of your payment

There are a variety of ways to appeal your PSLF Form payment amount if you think that you’ve missed a payment. First, you should know the payment amount. The payment count can sometimes be wrong. Sometimes, the servicer may give you the wrong result for example “Undetermined” or “Not a qualified borrower.” This doesn’t necessarily mean that you were wrong but it does not make the system flawless. There are plenty of resources, support and assistance available.

The next step is to review the financial aid statements. You can then determine whether you qualify for PSLF. PSLF waivers are available. PSLF waiver is available if you have an Federal Family Education Loan (Direct Consolidation Loan) or a Federal Direct Consolidation Loan. If you’re not sure if you’re eligible for a waiver to apply, make use of our PSLF Help Tool.

PSLF is an initiative of the federal government that allows students to repay federal student loans with 120 payments that are verified. If you’re denied, you can appeal your decision. Start by visiting the federal Student Aid web site, or by calling your PSLF provider. For help, contact the Ombudsman Group.

You can use the PSLFHelp Tool to help you determine the next steps if you receive an incorrect amount of payments. This tool, offered by the U.S. Department of Education, will also suggest the forms you need to complete to prove your qualifying work and get credits for your monthly payments. All receipts and financial statements that you receive must be kept in order to confirm the amount of your monthly payments.

It ends in 2024

The PSLF Form will end in 2024. Borrowers are encouraged not to wait to apply for forgiveness. You are eligible to apply for the forgiveness of federal student loans if are eligible. Deadline for submitting PSLF applications is October 31. The department of education will review the applications and notify borrowers who might be eligible to be granted forgiveness. If you are rejected, you have the right to appeal to the Consumer Financial Protection Bureau.

The PSLF program is not accessible for public employees and is subject to a an expiration date. Be aware that the PSLF includes your time spent in public sector employment. You could also get your repayment time included into the calculation. To be eligible for the PSLF, you must be in public service and have the approval of the Department of Education.

The Department of Education lowered the requirements for PSLF. For example, payments made on federal student loans count towards the 120 payments required to be eligible for the program. Each payment, regardless of whether you pay your federal loans on a regular basis or at a complete monthly, will count towards the PSLF.

If you’re PSLF Form isn’t filled out and you are not sure if it is, you should apply for it sooner rather than later. You can use the application to obtain a certificate of employment or forgiveness after you have completed it. It functions the same way as applying for a job. Complete your personal information and check boxes to explain the reason for filling in the application. You can also certify your employment prior to the 120-day deadline.