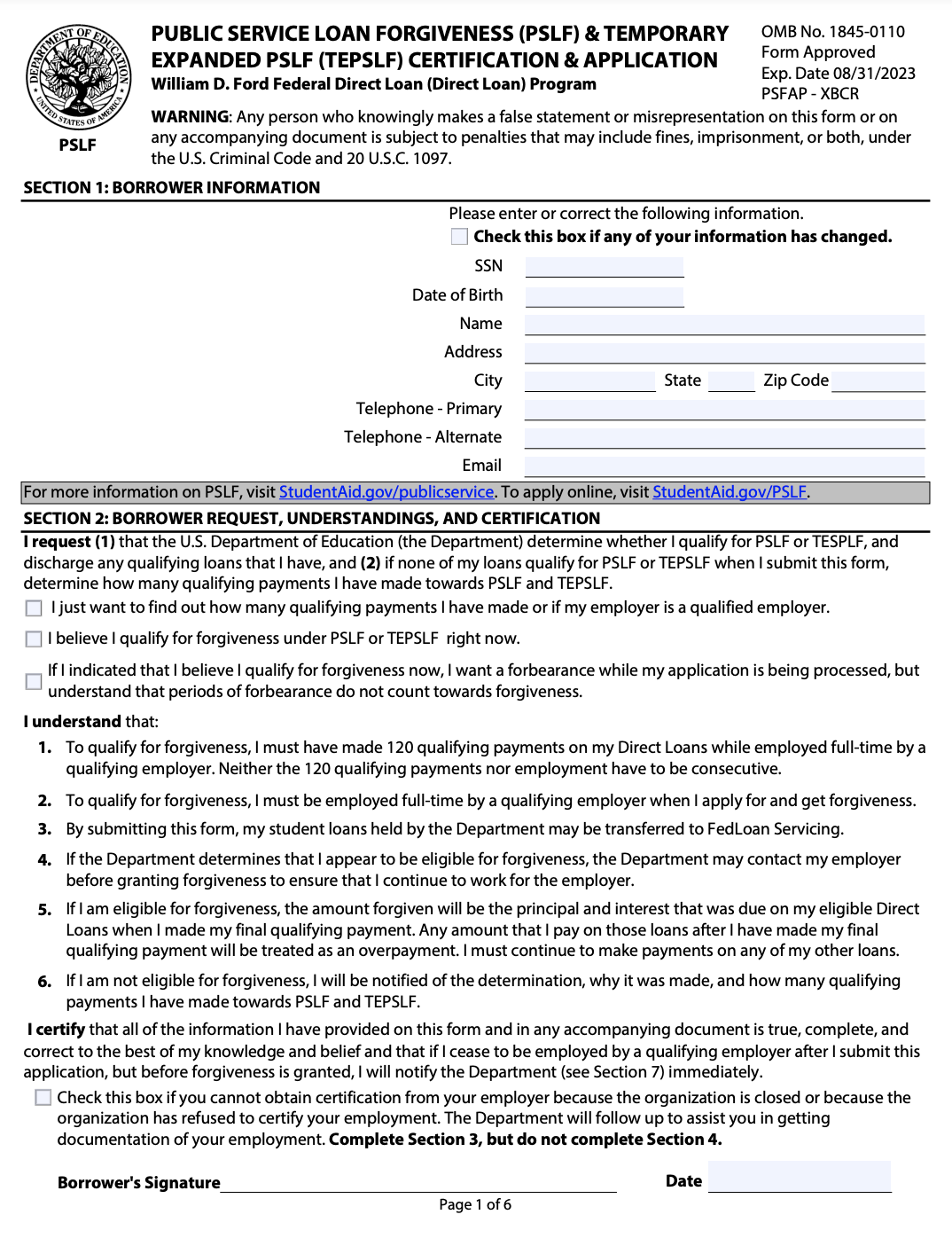

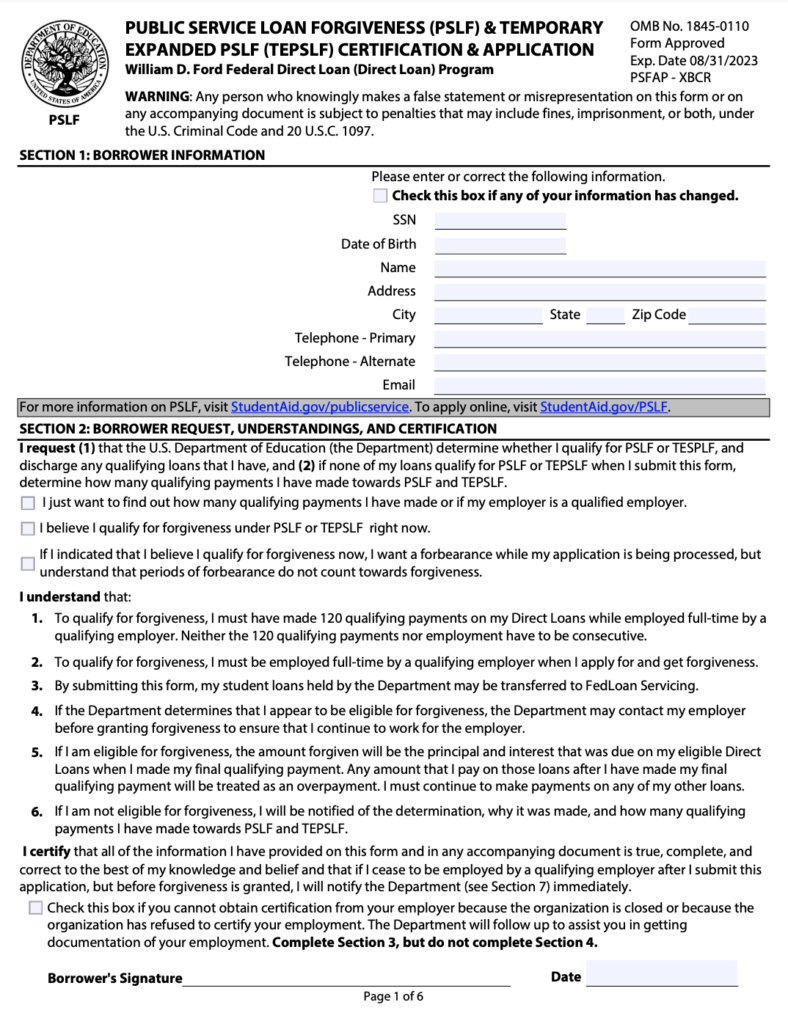

PSLF Form Submission – The PSLF Form is a 10-year-old digital record of all your employment information. You can appeal if you are not satisfied with the PSLF amount of payment. The deadline is set for 2024. If you work for several agencies, you may qualify for a lower payment waiver. Learn more about PSLF and complete the form.

PSLF forms provide a 10-year digital document of your employment background

The student loan record you receive will contain an PSLF form, which is a digital record of your employment record for up to ten years. It is used to determine your the eligibility requirements for repayment plans, monitor employment and record a journal with qualified payments. The Department of Education recommends recertification of employment at any time you make changes to your employer or income-driven repayment plan.

The Employment Certification Form should be filed every year in order to be eligible for the PSLF Program. This form demonstrates that you are still employed and meets the other conditions. This form is vitally important because it is the sole record that the government can use for the entire 10-year forgiveness period.

An Department Human Resources Analyst must sign the PSLF form. The employee also needs to complete the form. The form must be signed using a wet pen (pen), and submitted by the employee prior to the 31st of October, 2022. There may be additional administrative requirements imposed by the U.S. Department of Education. Be sure to follow the rules.

The federal government created the PSLF program and is the one that sponsors it. The Human Resources Department of Monterey will advise PSLF applicants. In addition, the Human Resource Analyst can verify the dates on your application. You might be able to benefit from the PSLF program by consolidating federal loans before the deadline expires. Before you fill out your PSLF form, make sure to read the waiver.

This lets you appeal against the amount you paid.

You are able to appeal the PSLF Form’s calculation of your payment if you missed the payment. First, you must know the amount of your payment. Be aware that your count might not be 100% exact. Sometimes the servicer might give you an inaccurate number like “Undetermined” and “Not a qualified borrower.” It doesn’t mean you’re not doing anything wrong, however, it’s not a perfect system. There are lots of resources and help available for you.

Then, take a look at your financial aid summary. You can then determine whether you are eligible for PSLF. PSLF waivers are available. PSLF waiver is available when you’re a recipient of the Federal Family Education Loan (Direct Consolidation Loan) or a Federal Direct Consolidation Loan. The PSLF Help Tool can help you determine if you are eligible.

PSLF (Public Service Loan Fund) is a federal program that helps to pay back federal student loans. You can do this by making a 120-day verified payment. If you’re denied, you can appeal your decision. The process can be started by visiting the federal Student Aid website, or phone your PSLF provider. For assistance, you may contact the Ombudsman Group.

In case you’ve received the incorrect number of payments, you can make use of the PSLF Help Tool to determine next steps. This tool, which is provided by the U.S. Department of Education (USDE) will assist to identify the documents you’ll need to prove your eligibility for monthly payments and credit. It is important to save every receipt, statement and invoices you get to enable your payments to be proven.

It will come to an end in 2024.

The PSLF Form will close in 2024. Borrowers are able to apply for forgiveness right now because the program is likely to end in 2024. If you’re eligible you may apply for forgiveness of your federal student loans. The deadline to submit a PSLF applications is October 31st. The department’s education team will assess applications and contact applicants who might be qualified. If your request is rejected you may appeal to the Consumer Financial Protection Bureau.

The program is available only to those employed in the public sector and lasts for a short period. You should remember that any time you work in public service is counted towards the PSLF. This calculation may also include period of repayment. To be eligible for the PSLF to be eligible you must be a member of the public service with approval from the Department of Education.

The Department of Education has relaxed the requirements for PSLF. Payments made on federal student Loans will count towards 120 required payment to be eligible. No matter whether you make your federal student loan payments in monthly installments or fully every month, every payment is counted towards the PSLF.

You might want to complete your PSLF form earlier than you anticipate. After the application has been completed you’ll have it available for employment certificate as well as for forgiveness reasons. It works the same way as a job application. It requires you to provide your personal details and then check boxes to indicate the reason you’re filling the form. You can also certify your employment prior to the 120-day deadline.