PSLF Form Myfedloan – The PSLF form provides an electronic record of your employment history over 10 years. It is possible to appeal if are not satisfied with the PSLF’s amount for payment. The program will expire in 2024. If you work at multiple agencies it is possible to be eligible for a limited repayment waiver. Find out more information regarding PSLF benefits and the process to complete the application.

PSLF form provides a digital trail that records your employment history for a period of 10 years.

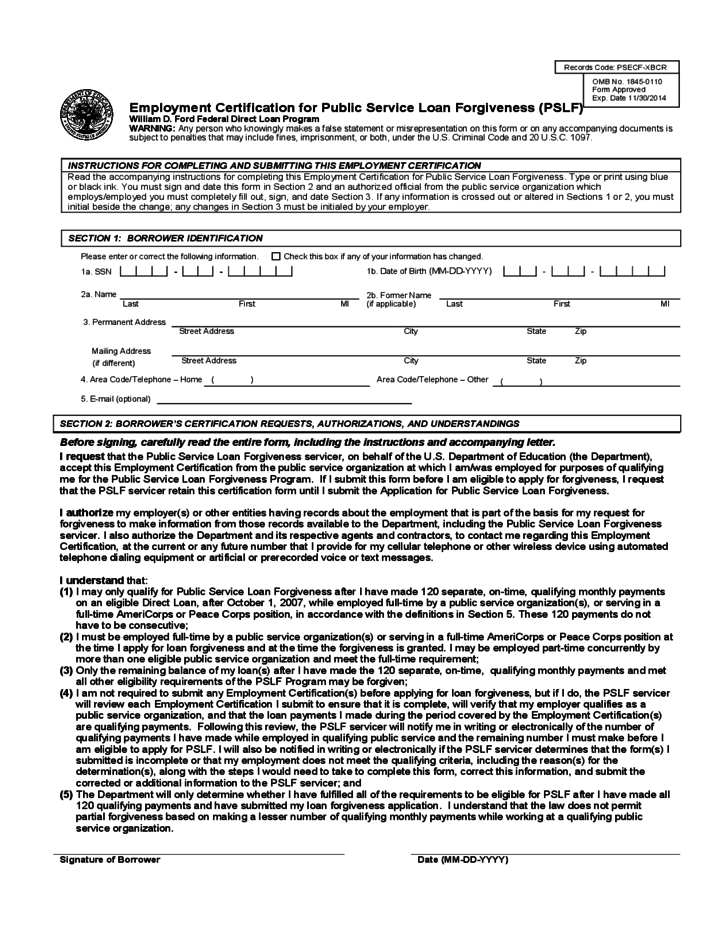

The PSLF Form Myfedloan is a ten-year digital track of your work history. This is added to the student loan record. It’s used to monitor employment eligibility and to log qualified payments. The Department of Education suggests that you recertify your employment each time you change employers or if your income-driven payment plan is modified.

The Employment Certification Form should be submitted every year to be eligible to participate in the PSLF Program. The form confirms that your employment status remains valid and meets the other specifications. It is crucial to submit this form on a regular basis, since it is the only paper trail the government has during the 10-year forgiveness time.

The PSLF form should be signed by both the Department Human Resources Analyst and the employee. It should be signed by a wet pen (pen), and submitted by the employee before the 31st of October 2022. Other administrative steps may be required for the U.S. Department of Education therefore, be sure to follow the guidelines.

The federal government financed the development and funding of the PSLF program. The Human Resources Department of Monterey will provide advice to PSLF applicants. Additionally the Human Resource Analyst can verify the dates on your application. If you’re not able or unwilling to be considered to be considered for the PSLF Consolidate your federal loans prior to the date. Before you submit the PSLF application, you should be familiar with the conditions.

You can contest the payment amount.

There are several ways to appeal your PSLF payment count form if you think you’ve been in arrears with an installment. First, you should know the amount of your payment. It is important to remember that the count of your payment can be inaccurate. Sometimes, the service provider might give you a wrong number. While it doesn’t mean you didn’t do anything wrong but it’s still not an ideal system. There’s plenty of help and resources at your disposal.

Next, look at the financial aid summary. From there, you can determine if you’re eligible to be considered for PSLF. You can apply for a PSLF waiver for Direct Consolidation loans and Federal Family Education Loans. You may also use the PSLF Help Tool to verify that you are eligible for PSLF.

PSLF is an federal program that allows you to pay your student loan debt through the federal government after you’ve completed 120 verified payments. If you’re denied, you can appeal your decision. You can begin the process by visiting the federal Student Aid website, or calling your PSLF provider. If you need assistance, call the Ombudsman Group.

If you do not receive the appropriate amount of payment If you don’t receive the correct amount of payments, use the PSLF Assistance Tool to find out next steps. The U.S. Department of Education will provide the PSLF Help Tool. It will show you the forms you need to complete in order to prove your eligibility for employment and get credit for your monthly installment. Keep any digital receipts and statements you receive to prove the amount you paid.

It will expire in 2024.

The PSLF Form will be ending in 2024. The borrower are advised to seek forgiveness as quickly as they can. It is possible to request forgiveness of federal student loans if are eligible. The deadline to submit PSLF applications is October 31. The department for education will evaluate applications and contact borrowers who might be eligible to be granted forgiveness. You can appeal against rejection to the Consumer Financial Protection Bureau.

The program is only available to public servants only and lasts for a short time. Remember that all time you’ve worked for the public service is counted towards the PSLF. It could also be a factor in repayment periods. In order for the PSLF to be eligible you must be a member of the public service and have approval from the Department of Education.

The Department of Education has lowered the requirements for PSLF. Payments made for federal student debt will be counted towards the 120 monthly payments necessary to be eligible for the program. It doesn’t matter if you make your federal student loan payments in monthly installments or full-time every month, each payment is counted towards the PSLF.

It is possible to apply earlier in the event that your PSLF application is not complete. You can use the application for employment certification or forgiveness after you have completed it. This application is very similar to a job request. You fill in your personal information and choose the boxes that explain the reason you fill it out. You can even sign off on your employment prior to the 120-day payment deadline.