PSLF Form Instructions – The PSLF is a 10-year record of your work. If you’re not happy with the amount of money you receive on your PSLF you may appeal. The deadline for appeals is 2024. If you are employed by multiple agencies, you could be eligible for a reduced payment waiver. Find out more information regarding PSLF benefits and how to complete the application.

PSLF form provides a digital trail that tracks your employment history for 10 years

The PSLF form is an electronic trail of your employment history, that spans ten years. This information is then added to your student loan record. It is used to track eligibility, log qualified payments, and determine if the employer is eligible for the repayment plan. The Department of Education recommends recertifying your employment every time you switch employers or change an income-driven repayment plan.

The Employment Certification Form must be completed every year by anyone who intends to apply for the PSLF program. This document confirms your employment status and meets the rest of the conditions. The only document that the government has during the 10-year forgiveness period is this form, which is why it is crucial to file regularly.

A Department Human Resources Analyst must sign, and the employee must also complete the PSLF Form. It should have an unwet sign (pen) and the employee must complete the form by the 31st of October 2022. The U.S. Department of Education other administrative steps may be required. You must follow the guidelines.

The federal government was the one who funded the development of the PSLF Program. The Human Resources Department of Monterey assists PSLF applicants. An Human Resource Analyst will review your application and confirm the dates. Consolidating federal loans may be necessary if you are not eligible to apply to the PSLF Program. Before you submit the PSLF application, make sure to read the terms.

This gives you the right to appeal the payment amount

There are several ways you can contest your PSLF Form payment number in the event that you believe that you’ve not received a payment. It is crucial to know the exact amount of your payments. Be aware that your payment count may not always be exact. Sometimes, the service provider will provide an inaccurate result such as “Undetermined” (Not a qualified borrower). It doesn’t mean that you did something wrong but it’s still not the perfect system. There are plenty of resources, support, and help to be found.

Then, you should review your financial aid report. This will allow you to determine if you are eligible for PSLF. You can request an PSLF waiver if you’ve got a Federal Family Education Loan or Direct Consolidation Loan. The PSLF Help Tool will assist you in determining if you are eligible.

PSLF (Public Service Loan Fund) is a federal program that helps you pay off student loans that are federally funded. You can avail this by making 120 verified payment. If you’re denied, you can appeal your decision. You can either start the process via the federal Student Aid site or call your PSLF provider. You can also contact the Ombudsman Group for help.

The PSLF Help Tool will help you determine the next steps to follow if you have received an incorrect amount of payments. This tool, which is provided by the U.S. Department of Education (USDE), will help you identify the forms that you’ll need to establish your eligibility to receive monthly payments and credit. It is important to save all digital receipts, statements and invoices you get to enable your payments to be proven.

It’s set to expire 2024.

The PSLF Form will end in 2024. The borrower is advised not to delay applying for forgiveness. This program allows you to ask for forgiveness of federal student loan debt when you meet the eligibility requirements. The deadline to submit PSLF applications is October 31st. The education department will review all applications and contact those applicants who might qualify to be forgiven. If you’re denied, you may make an appeal to the Consumer Financial Protection Bureau.

The program is available only to employees of the public sector. It is available for a limited time. Your employment in the public sector is counted toward the PSLF. In addition, your repayment period may be considered as part of the calculation. To be eligible for the PSLF you must be employed in the public sector and hold the permission of the Department of Education.

The Department of Education lowered the requirements to PSLF. For instance, the payments you make on federal student loans will count towards the 120 monthly payments needed to be eligible to participate in the program. Whether you pay your federal loans on per month or every month in full, every payment will count towards the PSLF.

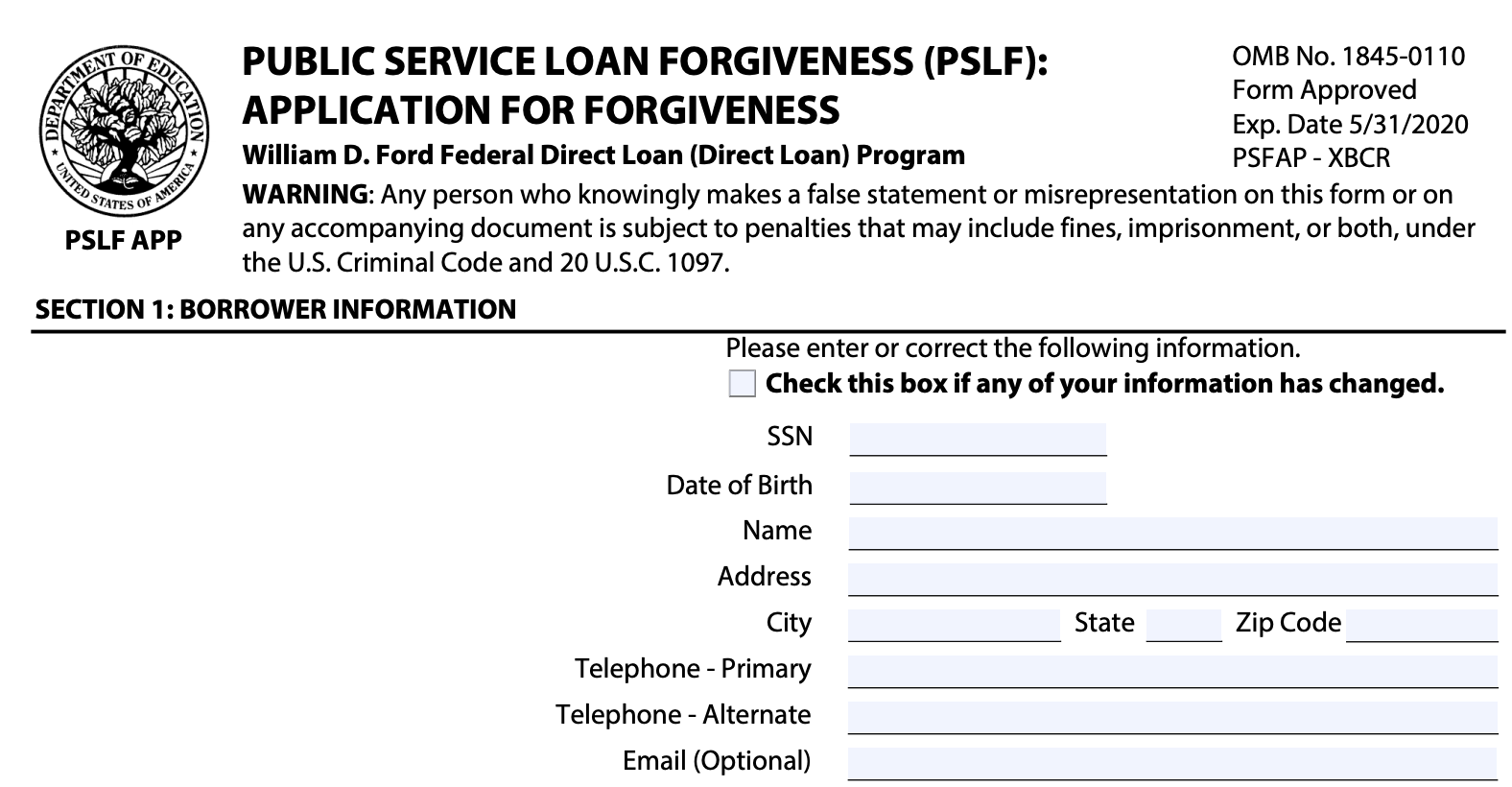

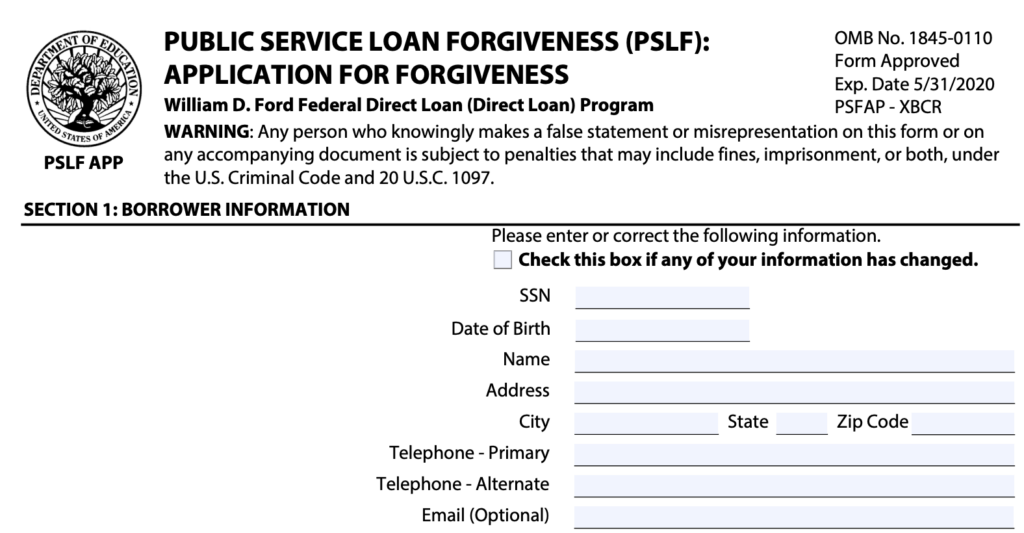

If you do not have an filled-out PSLF Form, it is worthwhile to apply sooner rather than later. After you’ve submitted the application it will be accessible for employment certification and forgiveness reasons. It’s similar to an application for a job. It is where you fill in your personal details. Then, check the boxes to indicate the reason you are filling in. You can even certify your employment before the deadline of 120 payments.