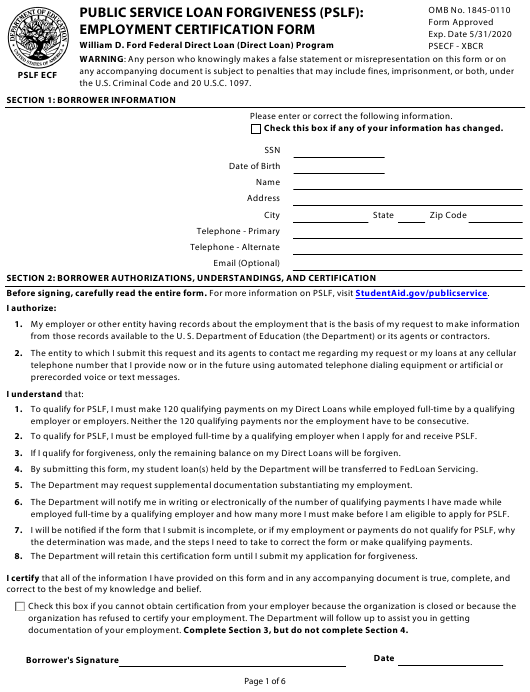

PSLF Ecf Form 2024 – The PSLF is a 10-year document of your employment. Appeal if you are dissatisfied with the PSLF amount of payment. The deadline for appeals is 2024. If you are employed by more than one agency, you may be eligible for an exemption to repay in part. Find out more information about PSLF benefits and the process to apply for it.

PSLF is a 10 year digital trace of your employment record

The PSLF form is an electronic trail of your work history that spans ten years. This information is then added to your student loan records. It is used to monitor your eligibility, track eligible payments, and to determine whether an employer is eligible to participate in the repayment plan. The Department of Education recommends recertification of employment whenever you make changes to the employer’s or income-driven repayment plan.

If you are planning to be eligible for the PSLF program, it is recommended to file the Employment Certification Form every year. This document proves that you’re active and fulfills all specifications. The form must be filed annually since it is the only form of documentation the government can make use of during the 10-year period of forgiveness.

The PSLF form has to be completed by an HR Department Human Resources Analyst, and the employee must sign the form. The form must be signed by an Analyst from the Department Human Resources. The employee has to complete the form by no later than October 31, 2022. The U.S. Department of Education might require additional administrative steps. Follow these guidelines.

The PSLF program was developed and funded by the federal government. The Human Resources Department of Monterey will provide advice to PSLF applicants. Furthermore the Human Resource Analyst can verify the dates in your application. Consolidating federal loans may be necessary if you are not eligible to the PSLF Program. When you are submitting your PSLF form, be sure to read the waiver.

You can appeal against the amount of your payment

There are a variety of ways to appeal your PSLF Form payment number if you believe that you’ve not received an amount. It’s important to understand what your payment count is. Sometimes, the payment count may be incorrect. Sometimes, the service provider may give you an inaccurate result, such as “Undetermined” or “Not qualified borrower.” This does not mean that you did anything wrong. But it does not mean that everything is flawless. There are plenty of resources, support, and help readily available.

Next, you need to check your financial aid summary. Once you’ve read your financial aid summary it will allow you to see if PSLF is accessible. The PSLF waiver can be sought if you have an Federal Family Education Loan (Direct Consolidation Loan) or a Federal Direct Consolidation Loan. To ensure you’re eligible to apply, make use of our PSLF Help Tool.

PSLF is an federal program that permits students to repay federal student loans with 120 verified installments. If you’re denied, you can appeal your decision. The federal Student Aid website can be used to begin the appeal process. You can also contact your PSLF provider. The Ombudsman Group can also be reached for assistance.

In case you’ve received the incorrect amount of checks, you can make use of the PSLF Help Tool to determine next steps. This tool, provided by the U.S. Department of Education (USDE), will help you identify the forms you’ll need to prove your eligibility for monthly installments and credit. It is important to save all receipts, statements and invoices that you receive in order for your payments to be legally substantiated.

It will end in 2024.

The PSLF Form will end in 2024. It is recommended that borrowers do not to wait to apply for forgiveness. If you’re eligible to the program, you will be able to apply for forgiveness for your Federal student loans. October 31 is the deadline to submit an application for PSLF. The education department will review all applications and contact those people who are eligible to be forgiven. If you’re denied, you can make an appeal to the Consumer Financial Protection Bureau.

This program is only available to public employees and has limitations on time. However, keep in mind that all the time you’ve worked for the public service is counted to be a part of the PSLF. The calculation could also include repayment periods. In order to be eligible for the PSLF you must work within the public sector and hold the permission from the Department of Education.

The Department of Education has reduced the eligibility requirements for PSLF. Payments made on federal student Loans will count towards the required 120 payment to be eligible. It doesn’t matter if you pay for your federal student loans in monthly installments or fully every month, each payment is counted towards the PSLF.

You might want to submit your PSLF form sooner than you anticipate. Once the application is completed, you will have it ready for your employment certificate and forgiveness purposes. The application is similar to a job request. It is where you fill in your personal details and select the boxes to indicate the reasons you’re filling it out. You can even accept your job before the 120 payments deadline.