Fillable PSLF Form – The PSLF Form is a 10 year-old digital record of your employment information. You can appeal if you are not satisfied with the PSLF amount of payment. The deadline is set for 2024. You could be eligible for a waiver of repayment that is limited in the event that you work for more than one agency. Find out more about PSLF benefits, as well as how to fill out the application.

PSLF Form is a digital trail of your employment history

The PSLF is an electronic record of your work history over 10 years, which is then added to the student loan record. It’s used to monitor employment eligibility, create a log of qualified payments and determine if an employer is eligible to participate in the repayment plan. The Department of Education suggests that you recertify employment whenever you change employers or when your income-driven repayment plan is modified.

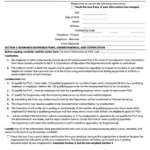

It is mandatory to submit an Employment Certification Form each year if you want to be eligible for the PSLF program. This form demonstrates that your employment status remains valid and meets the other requirements. It is vital to file the form annually, as it is the only evidence that the government has of your employment throughout the 10-year forgiveness period.

The PSLF form must be signed by an HR Department Human Resources Analyst, and the employee is required to be able to sign the form. It should be the signature of a wet pen (pen), and the employee has to submit the form before October 31, 2022. There may be other administrative steps to assist the U.S. Department of Education. Follow these guidelines.

The federal government established the PSLF program and sponsors it. The Human Resources Department of Monterey can provide guidance to PSLF applicants. Additionally the Human Resource Analyst can verify the dates on your application. If you are not qualified for the PSLF program you might need to consolidate federal loan before the deadline runs out. Before you submit your PSLF form, be sure to read the waiver.

It allows you to appeal your payment count

If you believe you’ve failed to make an installment There are several ways to appeal your payment count on the PSLF Form. First, you must understand your count of payments. Sometimes, the payment count may be inaccurate. Sometimes, the servicer will give you the wrong result, like “Undetermined” or “Not a borrower who is qualified.” This doesn’t necessarily mean that you’re not right, but it does not make the system perfect. There are lots of resources and support for you.

After that, you must review your financial aid report. You can then determine whether you qualify for PSLF. You can request the PSLF waiver to apply for Direct Consolidation Loans or Federal Family Education Loans. To ensure you’re eligible to apply, make use of our PSLF Help Tool.

PSLF is a federal program which allows you to pay off your federal student loan debt once you’ve completed 120 verified payments. If you’re denied, you can appeal your decision. The process can be started by visiting the federal Student Aid website or by calling your PSLF provider. The Ombudsman Group can also be reached for assistance.

The PSLF Help Tool will help you determine what next steps to take if you received the wrong amount of payment. This tool, made available by the U.S. Department of Education (USDE) can help you identify the forms that you’ll need to establish your eligibility for monthly payments and credit. You should also save all receipts and financial statements you receive to prove the amount you paid.

It will come to an end in 2024.

The PSLF Form will close in 2024. Borrowers may apply for forgiveness today because the program is expected to be discontinued. If you’re eligible for the program, you’ll be eligible to apply for forgiveness for your federal student debts. The deadline to submit a PSLF applications is October 31st. The department of education will review all applications and contact those borrowers who may qualify to be forgiven. If your application is rejected you may make an appeal to the Consumer Financial Protection Bureau.

The program is only available for employees of the public service and is temporary. Consider that the PSLF takes into account your time employed in the public sector. In addition your repayment time frame could be considered in the calculation. The PSLF is available only to people who are employed employed in the public service and have been approved by the Department of Education.

The requirements for PSLF are being lowered by the Department of Education. The payments made on federal student debt will contribute to the 120 monthly payments necessary to be eligible for the program. When you pay federal loans on an annual basis or in full each month each payment counts towards the PSLF.

It is best to start applying for your PSLF Form immediately in case you haven’t completed the form. When you’ve completed the application, then you’ll be able to utilize it to obtain employment certificates and forgiveness purposes. It is just like applying for a job. Complete your personal details and then tick boxes to explain your reasons for filling out the application. It is possible to confirm your employment prior to the 120-day payment deadline.