Fedloan Servicing PSLF Certification Form – The PSLF is a 10-year document of your employment. The appeal is to alter the amount of your PSLF payments. The deadline for appealing is 2024. It is possible to qualify to receive a repayment waiver with a limit in the event that you are employed by more than one agency. Find out more about PSLF Benefits and how to complete the form.

PSLF forms are a 10-year digital record of your employment history

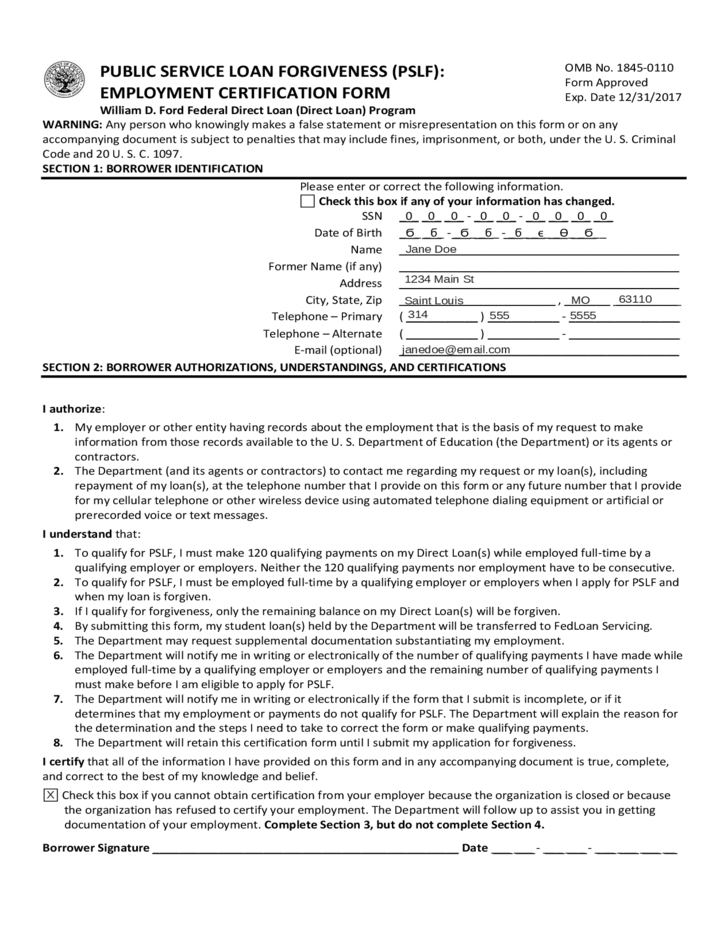

Your student loan records will include a PSLF form. It is a digital record of your employment history for 10 years. It’s used to monitor employment eligibility, make an account of eligible payments and to determine if an employer is allowed to take part in the repayment plan. The Department of Education recommends recertification of employment at any time you make changes to the employer’s or income-driven repayment plan.

If you are planning to be eligible to be eligible for the PSLF program, you should submit the Employment Certification Form every year. This form confirms that you’re still employed and meets the other prerequisites. It is essential to submit the form on a regular basis since it’s the only document the government can use during the 10-year forgiveness time.

The PSLF forms have to be signed by an analyst from the Department of Human Resources. Employees should also complete them. It must be signed by an HR Analyst in the Department. The employee has to complete the form by not later than October 31 2022. For the U.S. Department of Education other administrative procedures may be required. Make sure you adhere to the guidelines.

The PSLF program was developed and sponsored by the federal government. The Human Resources Department of Monterey offers advice on the matter for PSLF applicants. Also, the Human Resource Analyst will verify dates on your application. If you are unable or unwilling to be accepted to be considered for the PSLF Consolidate your federal loans before the deadline. Be sure to review the terms of the waiver prior to filling out the PSLF form.

You can contest your payment count

There are a variety of ways you can appeal your PSLF Form payment number if you believe that you have not received a payment. First, you must know the amount you paid. It’s crucial to be aware that the payment count isn’t always accurate. Sometimes, the service provider might provide you with a different result. However, it does not mean that you’re in any way guilty however it could indicate that the system isn’t perfect. You’ll have plenty of help and resources to use.

Then, you should review your financial aid report. This will enable you to find out if you qualify to apply for PSLF. If you’re a recipient of Direct Consolidation Loans, or a Federal Family Education Loan, you may be eligible for an PSLF waiver. If you’re not sure if you’re eligible for a waiver, you can also use our PSLF Help Tool.

PSLF is a federal program that allows students to repay their federal student loans by making 120 payments that are verified. If you’re denied, you can appeal your decision. You can begin the process by visiting the federal Student Aid website, or contact your PSLF provider. The Ombudsman Group can also be contacted to assist.

If you aren’t receiving the correct amount of money, you can use the PSLF Assistance Tool to find out what next steps to take. This tool is provided by U.S. Department of Education and will recommend the forms you should complete to establish your eligibility to work and to receive credit for your monthly payment. Keep any digital receipts and statements that you receive to verify your payments.

It is scheduled to end in 2024.

The PSLF Form will be ending in 2024. Students are advised to apply for forgiveness as soon as possible. It is possible to request the forgiveness of federal student loans if are qualified. The deadline for PSLF applications is October 31st. The department of education will review all applications and contact those borrowers who may qualify for forgiveness. You may appeal against the rejection to the Consumer Financial Protection Bureau.

This program is limited to public servants and only runs for a limited time. However, keep in mind that all the time you’ve worked in public service is considered to be a part of the PSLF. It could also be a factor in the time for repayment. You must be an official in the public sector and have received approval from the Department of Education to receive the PSLF.

The Department of Education has reduced the eligibility requirements for PSLF. Payments made on federal student loan loans are counted towards the 120 payments that are necessary to be qualified for the program. It doesn’t matter if you pay your federal loan on a monthly basis or in full each month All payments count toward the PSLF.

If you do not have an filled-out PSLF Form, it’s worthwhile to apply sooner rather than later. When you’ve completed the application, then you’ll be able to use it for employment verification and forgiveness purposes. It’s similar to an application for a job. It is where you fill in your personal details. Then, select the boxes to specify your purpose for filling out. You may even be able to confirm your employment prior to the deadline of 120 payments.