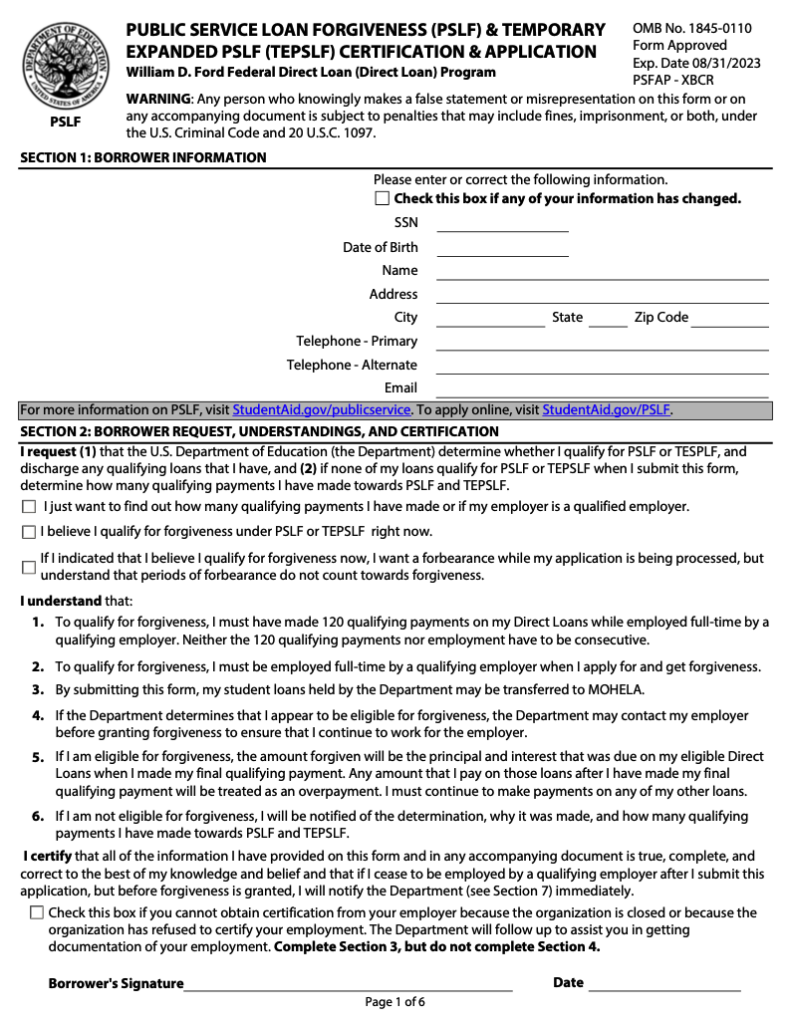

PSLF is a form that you can print to show that you have worked in a public service job. PSLF form can be used to help you get your loans forgiven. You may be eligible for PSLF if you work in a public service job and have made 120 qualifying payments on your Direct Loans. PSLF is a way to get your student loans forgiven if you work in a public service job. You may be eligible for PSLF if you work in a public service job and have made 120 qualifying payments on your Direct Loans. You can access the PSLF form on pslfforms.com

Qualifications For the Public Service Loan Forgiveness-PSLF

There are certain qualifications that are needed to be eligible for PSLF. You must:

- Work for a qualified employer.

- Have made 120 qualifying payments.

- Have Direct Loans.

Who is a Qualifying Employer?

A qualifying employer is can be a government organization at any level (federal, state, local, or tribal), a nonprofit organization that has been designated as tax-exempt by the Internal Revenue Service (IRS) under Section 501(c)(3) of the Internal Revenue Code (not including private foundations or nonprofit organizations whose primary purpose is political or religious advocacy), a public service organization, such as:

- An emergency management organization.

- Military service.

- A public safety organization (such as law enforcement or firefighting).

- A public health organization.

- A public library or public school system.

- A child or family services organization.

- A tribal college or university.

What is a Qualifying Payment?

A qualifying payment is a payment that is made:

- After October 1, 2007

- Under a qualifying repayment plan

- For the full amount due as shown on your bill

- No later than 15 days after your due date, and

- While employed full-time by a qualifying employer.

Qualifying repayment plans are:

- Standard Repayment Plan: You’ll have fixed monthly payments for up to 10 years.

- Graduated Repayment Plan: Your payments will start low and increase every 2 years.

- Extended Repayment Plan: If you have more than $30,000 in Direct Loans, you can choose this plan. You’ll have fixed or graduated payments for up to 25 years.

- Income-Based Repayment Plan (IBR): Your monthly payments will be 10% or 15% of your discretionary income, and you’ll have this plan for up to 25 years.

- Pay As You Earn Repayment Plan (PAYE): Your monthly payments will be 10% of your discretionary income, and you’ll have this plan for up to 20 years.

- Revised Pay As You Earn Repayment Plan (REPAYE): Your monthly payments will be 10% or 15% of your discretionary income, and you’ll have this plan for up to 25 years.

Have Direct Loans

To qualify for PSLF, you must have Direct Loans. These are loans that are made by the U.S. Department of Education. They include:

Direct Subsidized Loans

This is for students with financial needs. The government pays the interest while you’re in school and during your grace period.

Direct Unsubsidized Loans

This is for students regardless of financial need. You are responsible for paying the interest while you are in school.

Direct PLUS Loans

This is for graduate or professional students, and parents of dependent undergraduate students to help pay for education expenses not covered by other financial aid.

Direct Consolidation Loans

If you have direct Loans, you can consolidate them into a Direct Consolidation Loan to get one monthly payment. You might want to do this if you have multiple Direct Loans with different interest rates. PSLF also forgives the remaining balance on your Direct Consolidation Loan.

PSLF application process

You can apply for PSLF by completing and submitting the PSLF Application. The PSLF Application is available on pslfforms.com. The PSLF Application goes through a few steps before it is processed.

First, your loan servicer will review your application to make sure that you are employed by a qualifying employer, and have made 120 qualifying monthly payments. If you meet these requirements, your loan servicer will then send you a PSLF Employment Certification Form.

The PSLF Employment Certification Form is used to confirm your employment with a qualifying employer and to certify the qualifying payments that you have made. You can submit the PSLF Employment Certification Form as often as you want, but you must submit it at least once a year.

After you submit the PSLF Employment Certification Form, your loan servicer will review it and determine if you have made 120 qualifying monthly payments. If you have, your loan servicer will notify you and begin the process of forgiving the remaining balance on your Direct Loans.

The PSLF application process can be confusing and time-consuming. You may not know if you are eligible for PSLF, or what steps to take to apply. The PSLF application process has been made simple. Just visit pslfforms.com to download the PSLF form, fill it out, and submit it to your loan servicer. We will walk you through every step of the process.

Download PSLF Forms 2024

The PSLF form is available on pslfforms.com for you to download and print. pslfforms.com is a website that provides PSLF forms and other legal documents for free.

Frequently Asked Questions About PSLF Forms and Their Answers

Q: Can PSLF be used for private loans?

Ans: No, PSLF can only be used for Direct Loans.

Q: Can I apply for PSLF if I am not employed by a qualifying employer?

Ans: No, you must be employed by a qualifying employer to apply for PSLF.

Q: How do I know if I am employed by a qualifying employer?

Ans: You can check with your employer, or you can look up your employer on the PSLF Employer Certification Form.

Q: What happens if I do not have Direct Loans?

Ans: PSLF can only be used for Direct Loans. If you do not have Direct Loans, you will not be able to apply for PSLF.

Q: I am not sure if I qualify for PSLF. Who can I ask?

Ans: You can contact your loan servicer, or you can visit pslfforms.com to download the PSLF form. We will walk you through the PSLF application process.

Q: What happens if I do not complete the PSLF form?

Ans: If you do not complete the PSLF form, you will not be able to apply for PSLF.

Q: Do I need to submit the PSLF form every year?

Ans: No, you only need to submit the PSLF form once. However, you must submit the PSLF Employment Certification Form at least once a year.

Q: How long does it take to process the PSLF form?

Ans: It can take up to six weeks to process the PSLF form.

Q: What happens if I move or change jobs?

Ans: You will need to update your contact information on the PSLF form, and you will need to submit a new PSLF Employment Certification Form.

Q: What If I Have Other Types of Loans?

Ans: If you have other types of loans, you can consolidate them into a Direct Consolidation Loan, and then you may be eligible for PSLF.

Q: Where can I get the PSLF form?

Ans: PSLF forms are available on pslfforms.com